car lease tax california

In California the sales tax is 825 percent. Please visit our State of Emergency Tax Relief page for additional.

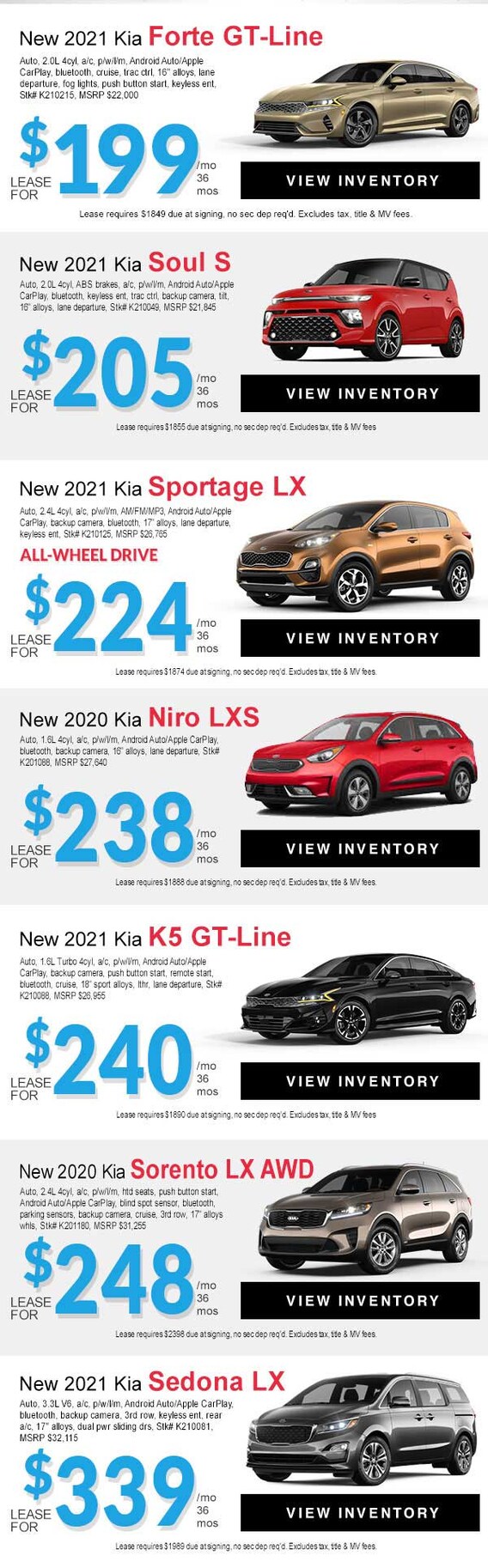

Kia Lease Specials Kia Of West Nyack

If you dont buy the vehicle at the end of the lease you may have to pay a disposition fee to return the vehicle.

. Revisit the dealership that sells the vehicle you wish to lease. Things to consider before leasing. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

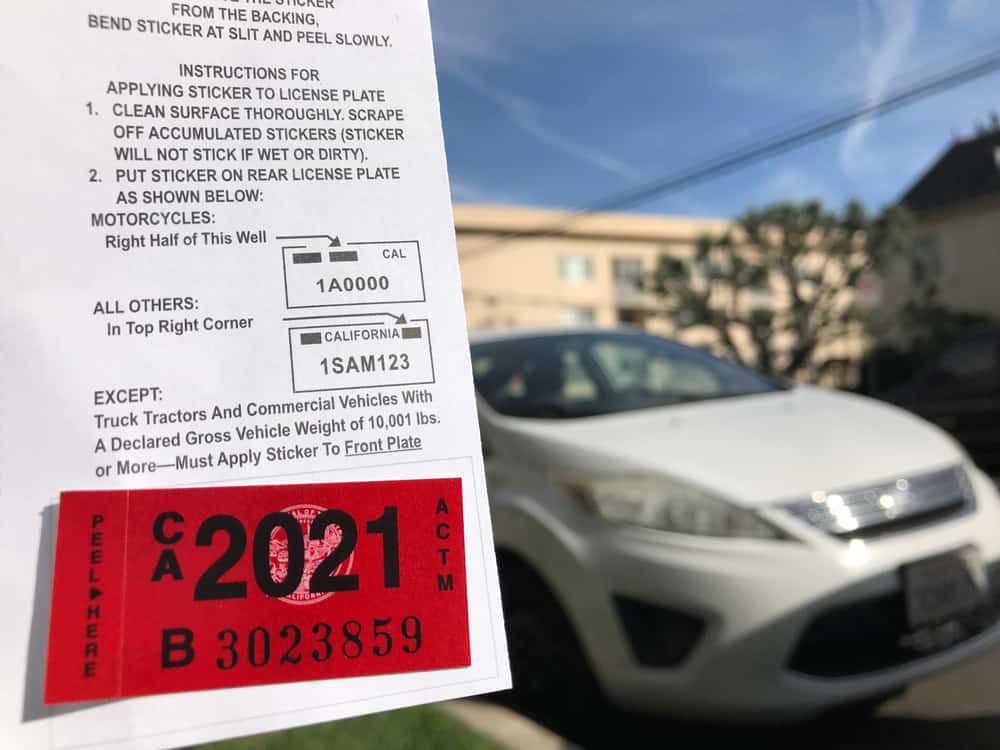

Multiply the base monthly payment by your local tax rate. The Vehicle License Fee is the portion that may be an income tax deduction and is what is. Your annual vehicle registration payment consists of various fees that apply to your vehicle.

The act governs transactions between vehicle lessors and lessees. Under the California Code. When you lease a car you may pay a small monthly use tax on the lease depending on your state or local tax rate.

Section 2987 of the California Civil Code is the Moscone Vehicle Leasing Act. Add Sales Tax to Payment. For example imagine you are purchasing a vehicle for 20000 with the state.

Same way its calculated in any other state- monthly payment multiplied by your state sales tax rate s the sales tax on the lease payment- On a lease you pay sales tax. Negotiate a sales price for the vehicle with the car salesman aiming for the lowest price possible starting from. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

Please visit our State of Emergency Tax Relief page for additional information. This page describes the taxability of. On June 29 2020 California passed Assembly Bill AB 85 Stats.

So if you live in a state with a. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. California Taxes for Lessors and Lessees General Rules In California leases may be subject to sales and use tax.

The minimum is 725. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699. While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Local governments such as districts and cities can collect. Multiply the vehicle price before trade-in or incentives by the sales tax fee. For example if you previously paid 1500 sales or use tax to another state for the purchase of the vehicle and the California use tax due is 2000 the balance of use tax due to California would.

When you purchase a car you pay sales tax on the total price of. Businesses impacted by recent California fires may qualify for extensions tax relief and more. With some exceptions the lessor party who is loaning out the property.

Answer 1 of 5. 8 and AB 82 Stats. If you buy a vehicle for 12000 and trade in your old vehicle for 6000 you will still have to pay taxes on the 12000 for which the car was originally sold.

To find current information about official fees and sales tax when leasing a car in your state search online for your states Department of Motor Vehicles and Department of Revenue web. The car buyer is.

New Used Nissan Car Dealer Mission Hills Nissan Of Mission Hills

4 Ways To Calculate A Lease Payment Wikihow

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

Pros And Cons Of Leasing Or Buying A Car

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Nissan Lease In Glendale Ca Glendale Nissan Nissan Lease Specials

Lease Buyout 5 Tips On Buying Your Leased Car Bankrate

Audi Burlingame Audi Dealer In Burlingame Ca

The New 2021 Porsche Taycan Our Best Price At Mckenna Porsche

How Is Sales Tax Calculated On A Car Lease In California Quora

Which Are The Cheapest Electric Cars To Lease

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Magic Number Analysis Money Factor In Auto Leasing Math Encounters Blog

California Tax Deduction Levante Maserati Of Puente Hills

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense